36+ when should i lock my mortgage rate

Web When to lock depends on the closing date of your home purchase. Web You can typically lock in a mortgage rate for 15 to 60 days.

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet

Web If mortgage rates fall after you lock your rate you still have options.

. Ask your lender to lock your rate. You may be able to stop the process with your current lender and start over with a different. Web Rate locks are typically available for 30 45 or 60 days and sometimes longer.

Web If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan. If your rate is not locked it can change at any time. If you dont want to miss.

Web Your lender might lock in a mortgage rate for a fee as a way to protect you from any interest rates increases while you shop for a home. That includes both conforming and non-conforming loans. Web The steps to locking in your mortgage rate are very simple.

We will extend your rate lock at no cost to you. Web When you choose to lock in your rate its stabilized for a set period of time often 30 45 or 60 days though shorter and longer periods may be available based. Web Rate lock periods usually last between 15 and 60 days with longer-term rate locks being more expensive.

Select mortgage lenders may offer a rate lock extension. Web If you see a competitive mortgage rate when you start your mortgage application it may no longer be there weeks or months later when you finally close. Web A rate lock is when your lender agrees to honor a particular interest rate by locking it into your loan for a certain amount of timetypically 30-60 days or long.

The length of your lock period depends on. Web You may be able to lock in the interest rate when you file your application during the processing of your loan or when your loan is approved. If interest rates are generally trending upward you should lock in sooner rather than later before rates spiral higher.

You usually can lock in a. You cant actually lock your rate in your lender must lock the rate. When you choose the term of your mortgage rate lock the shorter the term the lower the.

Web Sign No. Interest rates are rising. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days.

There can be a downside to. You may be able.

When Should I Lock My Mortgage Rate

How Long Can You Guarantee An Interest Rate The Washington Post

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

When Should You Lock In Your Mortgage Rate Right By You Mortgage

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Everything You Need To Know About A Mortgage Rate Lock Trulia S Blog Money Matters

When Should You Lock In Your Mortgage Interest Rate Mortgage Blog

Decentralized Finance De Fi Pdf

Mortgage Rate Locking Meaning When To Do It Mashvisor

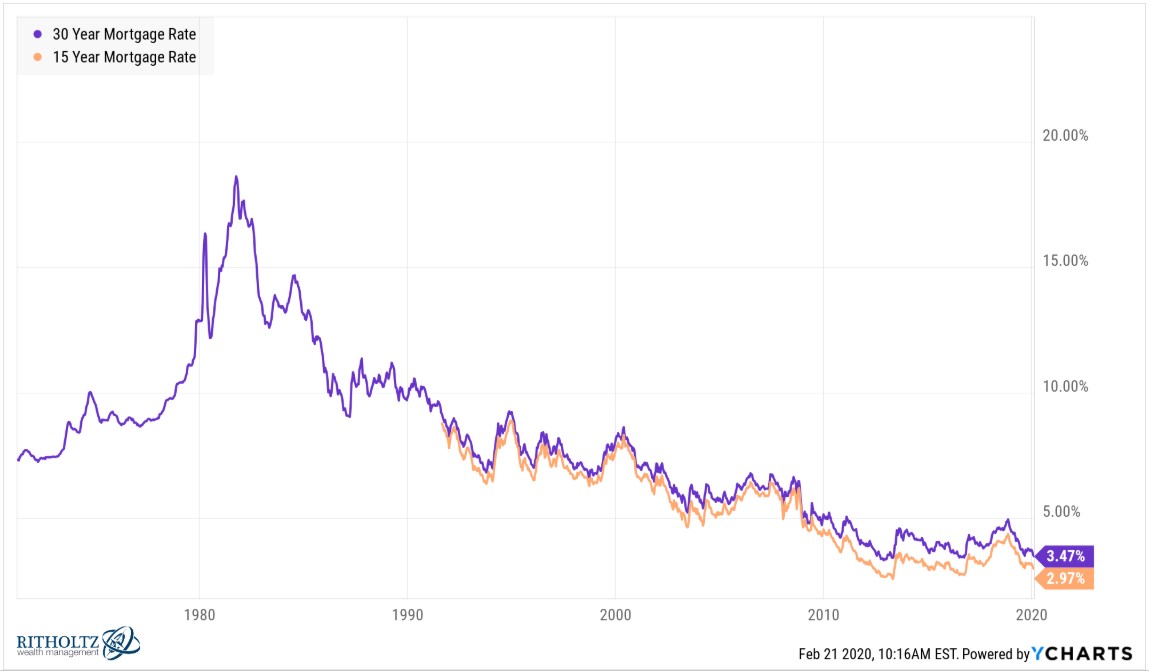

Should You Pay Off Your Mortgage Early With Rates So Low

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

When Should I Lock In My Interest Rate When Can You Lock Interest Rate First Time Buyer Tips Youtube

:max_bytes(150000):strip_icc()/shutterstock_202412650.lock.in.rates.mortgage.resized-5bfc313746e0fb005145dfee.jpg)

Got A Good Mortgage Rate Lock It In

Mortgage Rate Lock Guide When To Lock In Rocket Mortgage

Best Of Money Awards 2023 Moneygenius

When Should You Lock In A Mortgage Rate Debt Com